Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time. Our additions consist of net income, the treasury stock re-issuance, and the capital stock issuance. By adding each of the columns on the left — excluding the number of shares — the owner’s equity at the beginning of 2020 is $26 https://online-accounting.net/ million. All financial statements are closely linked and supplemental disclosures are meant to ensure there is no misunderstanding from investors. Other Comprehensive Income → The OCI account records the accumulated revenues, expenses, and gains that have not yet been realized. Until the activity is formalized (e.g. an investment is liquidated and converted into cash), the amount remains in the OCI account.

A company’s debt level might be fine for one investor while another might have concerns about the level of debt for the company. Also, purchases of fixed assets such as property, plant, and equipment are included in this section.

What is a Statement of Changes in Equity

The following reflects the Company X’s statement of stockholders’ equity. Note that “Net parent investment” is adjusted to $0 on the spin-off date to reflect the new equity structure. Example CO 6-1 provides an equity presentation in a carve-out entity’s statement of stockholders’ equity. Financial statements are also read by comparing the results to competitors Statement of changes in equity or other industry participants. By comparing financial statements to other companies, analysts can get a better sense on which companies are performing the best and which are lagging the rest of the industry. For example, some investors might want stock repurchases while other investors might prefer to see that money invested in long-term assets.

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. For-profit primary financial statements include the balance sheet, income statement, statement of cash flow, and statement of changes in equity. Nonprofit entities use a similar but different set of financial statements. For U.S. business corporations, the statement of changes in stockholders’ equity is one of the required financial statements.

What is an Equity Statement?

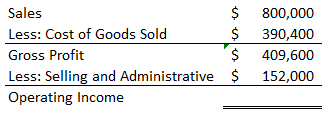

The purpose of an external auditor is to assess whether an entity’s financial statement have been prepared in accordance with prevailing accounting rules and whether there are any material misstatements impacting the validity of results. The rules used by U.S. companies is called Generally Accepted Accounting Principles, while the rules often used by international companies is International Financial Reporting Standards . In addition, U.S. government agencies use a different set of financial reporting rules. Investors and financial analysts rely on financial data to analyze the performance of a company and make predictions about the future direction of the company’s stock price. One of the most important resources of reliable and audited financial data is the annual report, which contains the firm’s financial statements. The balance sheet provides an overview of assets, liabilities, and shareholders’ equity as a snapshot in time. Before the statement of changes in equity can be prepared, the income statement must precede.

Noon Sugar Mills : Transmission of Quarterly Report for the Period Ended on 31-12-2022 – Marketscreener.com

Noon Sugar Mills : Transmission of Quarterly Report for the Period Ended on 31-12-2022.

Posted: Mon, 30 Jan 2023 10:24:15 GMT [source]

We finally arrive at the sixth, which is ending balances, by performing the necessary additions and subtractions. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Transfer every transaction within each equity account to a spreadsheet, and identify it in the spreadsheet. The CFS is, therefore, more comprehensive with regard to understanding the financial health of a company, but does not offer the same type of transparency into any specific line item. If you want to learn accounting with a dash of humor and fun, check out our video course.

Investing Activities

Aggregate the transactions within the spreadsheet into similar types, and transfer them to separate line items in the statement of changes in equity. Each of the components that impact the equity account is listed in the top row, with the corresponding change listed below. Dividend payments issued or announced during the period must be deducted from shareholder equity as they represent distribution of wealth attributable to stockholders. This ending equity balance can then be cross-referenced with the ending equity on thebalance sheetto make sure it is accurate. Renaming the ‘Statement of changes in equity’ is not in compliance with the Accounting Standards, but is it common practice for certain entity types such as managed investment schemes. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

If there is only negligible activity in this section and the only change for the period is in earnings, then a statement of retained earnings may be used. For this reason, the income statement must be prepared first, followed by the statement of retained earnings.

In essence, any increases and decreases to equity are added and deducted from the previous period’s balance to get the new equity balance. Equity, in the simplest terms, is the money shareholders have invested in the business including all accumulated earnings. Prior Period AdjustmentsPrior period adjustments are adjustments made to periods that are not current, but have already been accounted for. There are many metrics where accounting uses approximation, and approximation may not always be an exact amount, and thus they must be adjusted frequently to ensure that all other principles remain intact. Have to apply retrospectively, which results in adjustments in the preceding period and then restated financial position.

- Until the activity is formalized (e.g. an investment is liquidated and converted into cash), the amount remains in the OCI account.

- Analysts need data with predictive ability, hence income from continuing operations is considered to be the best indicator of future earnings.

- Below is a portion of ExxonMobil Corporation’sbalance sheet for fiscal-year 2021, reported as of Dec. 31, 2021.

- Other income could include gains from the sale of long-term assets such as land, vehicles, or a subsidiary.