Encumbered funds are most commonly used in government accounting to make sure there’s enough money set aside to meet specific obligations and purposes. Encumbrance journal entries and accounting are also sometimes called commitment accounting. This naming makes more sense when you realize that encumbrance enables budgetary control by recording money that is allocated for future projects, preventing over-expenditure of a budget. An important part of business finance and cash flow is making sure you understand how much of your available funds you can afford to place in reserve for the encumbrance account.

It is critical that all project related https://1investing.in/s are paid before the final reports are submitted. Further, any open encumbrances that will not be paid must be liquidated in Procurement. Encumbrances and open balances represent expenses that are anticipated to be charged to a budget or, in some cases, restricted funds.

Share this document

The encumbrance is marketed in your organization’s accounts once you reserve the money. When the money is paid out, the bookkeeper zeros out the encumbrance account and reports the money as a paid expense. The concept is most commonly used in governmental accounting, where encumbrances are used to ensure that there will be sufficient cash available to pay for specific obligations. By using encumbrances, a government entity can be assured that it will not over-extend its finances. A downside of encumbrances is that they increase the complexity of government accounting to some extent. Then, the procuring company converts the encumbrance into an expenditure by transferring the transacted items from the encumbrance account into accounts payable.

- Write a brief memo to your boss outlining the advantages and disadvantages of belonging to this trade association for benchmarking purposes.

- Encumbrances are for internal planning and monitoring only and will NOT be reflected on invoices or reports to the sponsor.

- When a real estate property has a lien or easement, it is considered encumbered.

- Reserving money for contingent expenses such as owing damages in a lawsuit.

- An encumbrance can also apply to personal – as opposed to real – property.

Banks must specify assets that creditors can take possession of if the bank fails to meet its commitments. If a borrower defaults, the lender can liquidate the asset to recover their cash. Serving legal professionals in law firms, General Counsel offices and corporate legal departments with data-driven decision-making tools. We streamline legal and regulatory research, analysis, and workflows to drive value to organizations, ensuring more transparent, just and safe societies.

Encumbrance Accounting

Please avoid this problem, by making sure all invoices have the correct Purchase Order number assigned to them for proper payment. Pre encumbrance is a commitment to pay in the future for the goods or services that are ordered but not yet received. It reserves the money for your future payments so the money cannot be used for any other activities than what it is intended for. This encumbrance is later converted to expenditures when goods or services are subsequently procured.

JEFFERIES FINANCIAL GROUP INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations. (form 10-Q) – Marketscreener.com

JEFFERIES FINANCIAL GROUP INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations. (form 10-Q).

Posted: Mon, 10 Apr 2023 21:00:12 GMT [source]

The breakdown by account code can be found in MyFinancial.desktop under the Current Encumbrances report. Encumbrance and open balance information is based on data from Workday and Ariba. In finance, encumbrance refers to the controls accounting systems use to prevent overspending.

Encumbrances determine the purpose of funds before organizations have spent any money or made a purchase. Do you wish you could get a better picture of your organization’s true financial snapshot at any moment? This is why we allow you to record these obligations at the time they are foreseen, even if the services haven’t yet been rendered or the billing hasn’t taken place. The purpose of accounting for encumbrances is to prevent the overspending of an appropriation. Encumbrances reserve a portion of an appropriation representing an obligation that has not been paid, or commitments related to unperformed contracts for goods and services.

Purchase Orders

Once the vendor approves the transaction, the commitment converts into a legal obligation. The procuring organization becomes liable to make a payment in the future. An example of an encumbrance transaction is the approval of the purchase order. Make any adjustments to the credits and prior year budget reference lines of the posted POADJ journal entries. Purchase Orders are the legal form that the Purchasing Department issues to a vendor to contract to buy goods and/or services.

Money from the encumbrance account is moved into the appropriate account to pay the invoice, and accounts payable handles the vendor payment. During the initial pre-encumbrance phase, someone submits a request to reserve money for a future payment. This money during this phase has been requested, but not yet approved for the purchase. Then, when that request is approved, a purchase order can easily be made for the exact amounts.

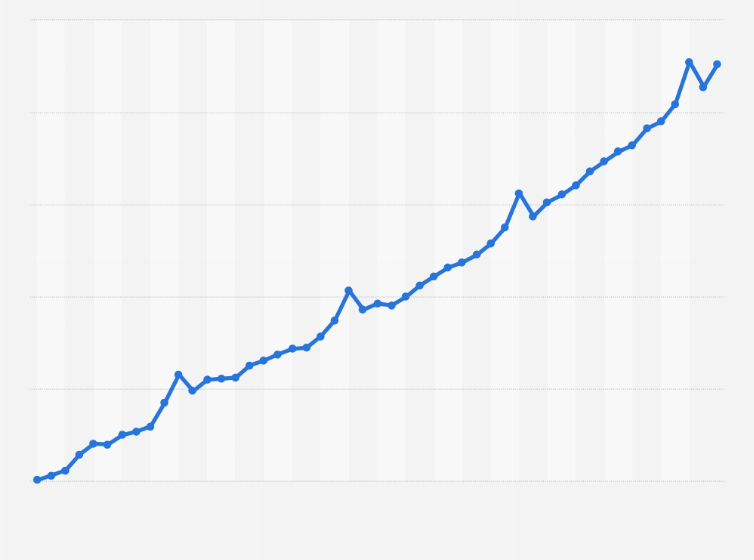

They’re better able to keep their expenditures within the allocated budget and more accurately predict cash flow. Encumbrance accounting helps your company with budget visibility and analysis by recording planned future payments. Rather than just looking at current transactions, this type of accounting encourages tracking upcoming expenses to help show a more detailed view of your cash flow. Verify purchase order transactions so you can see what encumbrances materialized into actual paid expenses.

GBT TECHNOLOGIES INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION (form 10-K) – Marketscreener.com

GBT TECHNOLOGIES INC. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION (form 10-K).

Posted: Wed, 12 Apr 2023 12:24:05 GMT [source]

A mechanic’s lienis a claim on personal or real property the claimant has performed services on. An example is if a contractor made adjustments to your property that were never paid for. Judgment liens are secured against the assets of a defendant in a lawsuit. Encumbrances will be recorded in the agency’s/department’s accounting system. An encumbrance is not recognized as an expenditure when recorded as the items or services have not been received. An encumbrance will increase the unliquidated encumbrance amount and decrease the unencumbered balance.

The Advantages of a Budget Within a Project

How often are encumbrance review notifications submitted to PIs /department administrators and OVPR? Encumbrances are analyzed and review notifications are forwarded by GCAS on a quarterly basis. Our Purchase Orders are printed with our Terms and Conditions which form the contractual agreement of the transaction. A restrictive covenant is an agreement that a seller writes into a buyer’s deed of property to restrict how the buyer may use that property.

At the time a purchase order is issued, the encumbrance account is increased by the amount of the purchase orders – in this case, $40,000. Expenditures of $39,100 will be recorded when goods are received along with the invoices, and at that time the $40,000 encumbered will be also be reversed out. Salaries and benefits make up an important part of encumbered funds, suggests the cloud spend management system Purchase Control.

The california income tax rate accounting rules may be used to record adjustments and make corrections to the encumbrance accounts and the reserve for encumbrance accounts. Encumbrance transactions are entered through the Budgetary Control module using the encumbrance adjustment screens. Financial statements indicate how budgetary resources are allocated to payment commitments before the actual expenditure incurs with encumbrance accounting. “Obligated” funds are commonly referred to as encumbrances – meaning the institution has issued a purchase order for goods and services or has signed a contract.

The FASB gives guidance for reporting restricted cash on the balance sheet and in cash flow statements. Many businesses achieve budgetary control instead of using encumbrance accounting by comparing budgeted accounts by responsibility center and the resulting financial statements with actual amounts . The companies track and analyze differences as favorable and unfavorable variances. Encumbrance accounting is also referred to as commitment accounting, which involves setting aside money ahead of time to meet anticipated expenses. The amount is set aside by recording a reserve for encumbrance account in the general ledger. This is to ensure that the organization has sufficient funds to meet anticipated payment obligations.